Ecommerce - Mastering Stock Turn for Success

For any physical product based business selling online (B2B or D2C), efficient stock management is vital to maintain a competitive edge in the...

Complete accounting solutions focussed on profit and growth

Inventory management systems play a crucial role in thriving product businesses

Automating your core systems is the key to efficiency and effectiveness

Scalable software that grows with you

Product and inventory software that makes sense

Seamless integrations and automations

Whether they use a single solution or a full end-to-end integration of multiple software packages we are proud to be a part of our client's success.

4 min read

Philip Oakley

:

Jun 12, 2023 2:16:00 PM

Many businesses rely on some pretty basic barometers of success.

Some will look at sales turnover, some profit while others, maybe more stressed business owners, will be all about the balance at the bank. A wise person once said. Turnover is vanity, profit is sanity but cash is king! Without profit, the cash will flow out faster than you can get it in.

Some will look at sales turnover, some profit while others, maybe more stressed business owners, will be all about the balance at the bank. A wise person once said. Turnover is vanity, profit is sanity but cash is king! Without profit, the cash will flow out faster than you can get it in.

While the sane and wise business owner may be looking at profit (both the gross profit on sales after deducting direct expenses and/or net profit after deducting all business expenses) few are looking at profit margins at a more detailed level that ultimately lead to a healthy cash balance.

The more detailed profitability could include:

1. Profit per product or service

2. Profit per customer

3. Profit per order

While we may know our overall profitability, say net profit for the month, we do not always know what customers or which product or services contributed the most or least amount of profit.

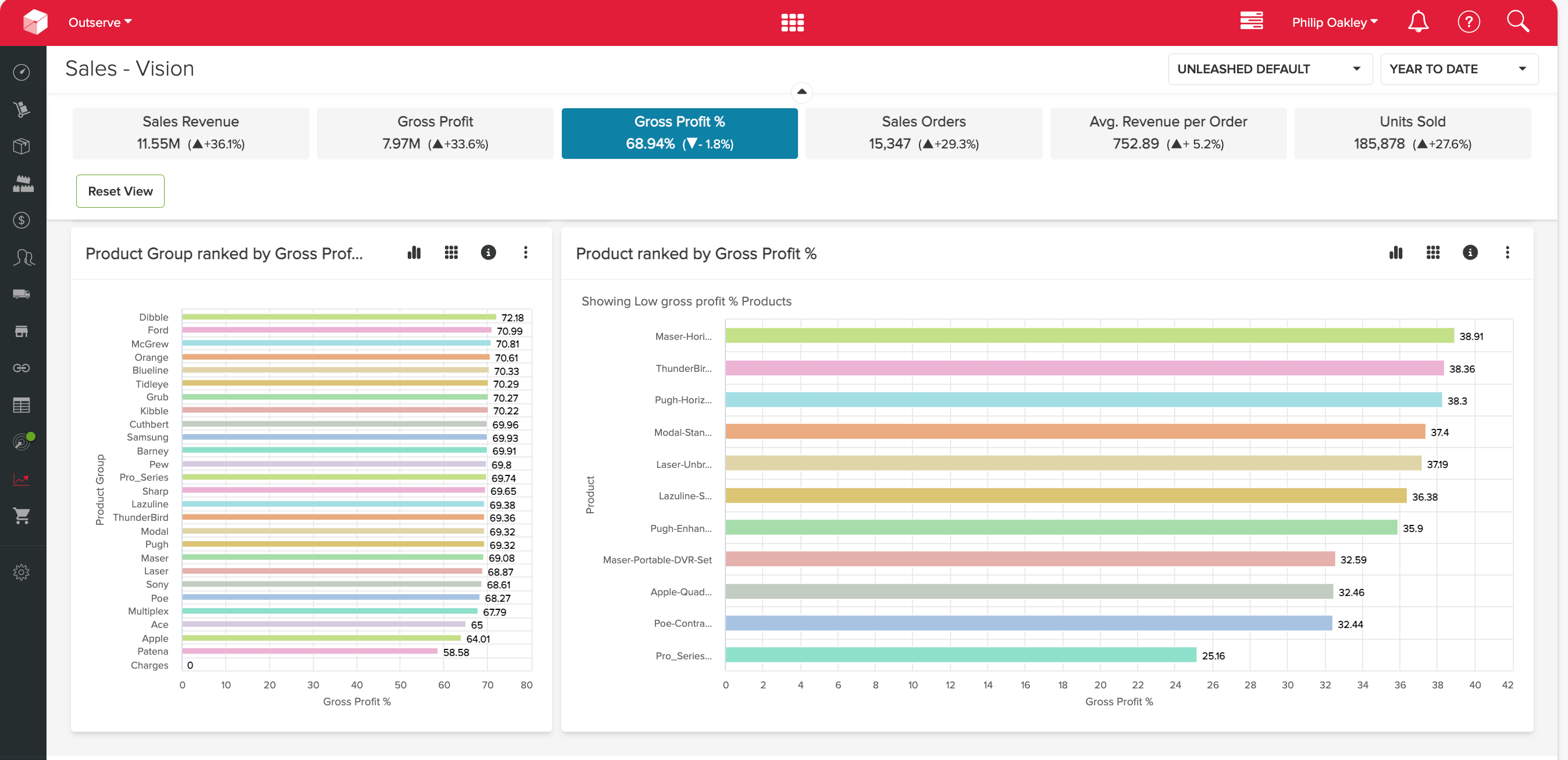

I am always interested in looking at the least profitable (the graph above has been filtered to show the least profitable products by gross profit %). These can give some great metrics that offer real actionable improvements and relatively successful businesses can easily hide some pretty awful customers and poor margin products lost in the total of profits. By analysing a more granular level, you can find these devils in the detail and remove these drains on overall profitability. We will break down where these problems usually lie in a moment!

I hear some of you say that any profit is a contribution to the whole so what is the problem with these lower margin sales? But we rarely see low margin sales that do not take some other additional resource that could be better deployed elsewhere. This is the hidden cost that is further compounding on our least profitable interactions.

These are often resources that are not infinite, including:

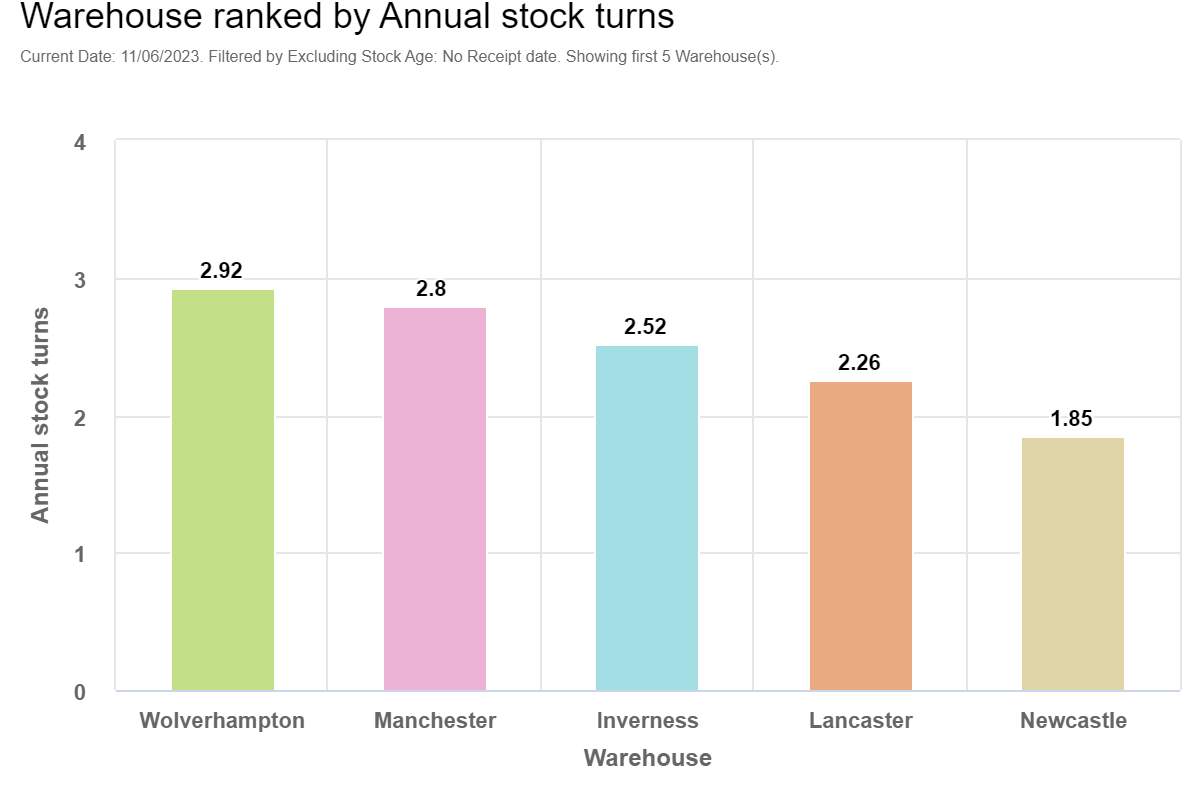

- Space in warehouse

- Employee time

If you do not know what margins on products or services we are making on specific customers how can we decide on whether our resources would be better relocated? Or, more specifically, where these resources are currently being wasted and how much that is costing your overall profitability (and therefore, ultimately, cash in the bank!).

So many times we see a very interesting directly correlation between low margin and hassle, grief, hard work (let’s just call them ‘profit leakages’!)

By understanding these ‘profit leakages’ you can shore them up through good decision making. Good decision making comes from good data and analysing it for trends.

Low Margin Customers

Some customers just cost more to work with. Whether that’s due to the cost of acquisition (marketing, offers, sales person’s time etc) or because they frequently require additional after sales care or return items, they simply have behaviours that cause them to eat into their overall margin.

When analysing a low margin customer we often notice that they are often hard work for many reasons. More demanding on time, more likely to complain and more likely to be poor payers. In ecommerce this could based on the source of customer such as Facebook, TikTok, Google Ads etc and there relative cost of aquistion

Low Margin products

Some low margin products can sometimes have the highest return rates or most amount of customers complaints. Low margin commerce products are often related to the ‘high demand, high competition’ situation which creates the race to the bottom on commerce platforms like Amazon and other price comparison channels.

We may be happy with the high sales volume, low margin situation but by playing this game we have attracted customers who are buying on price alone.

Many of these ‘bargain hunter’ customers show similar traits, such as:

1. They show little loyalty to products or brand, let alone the supplier (thats you!)

2. Although they don’t buy based on the level of customer service, some will be first to complain if they are not receiving the ‘John Lewis’ treatment while trying to pay Poundland prices which can lead to more returns on these products. If cash is king, refunds are robbing the crown jewels!

3. They are very difficult to upsell to or sell other products as they will only be looking for the cheapest price on everything that they buy.

As you can see, the low margin products often also attract behaviours that cause low margin customers. What margin there was on the product in the first place is eaten away at and the interaction gives you little room to create a lasting, beneficial relationship with a customer.

To begin margin analysis, you need great data. This often starts with great systems for inventory management (IMS) such as Unleashed and accurately tracking your costs. This may not be the only place to look however. Using a system like A2X to accurately consolidate payouts and associated fees from your ecommerce platforms can also help to give accurate figures.

An IMS like Unleashed will also give you actionable data relating to customer returns or returns on a product basis. This can help you sniff out the products and customers that are creating a lower margin.

From the data gathered in Unleashed, ABC analysis can also be performed (using reporting tools like Microsoft Power BI) which will direct you to your slow moving, higher warehousing cost products.

Finally, a CRM system, such as Hubspot, will allow you to track customer communications. High interaction customers are likely causing a hidden cost in staff time to deal with.

Once you’ve found your low margin products and customers, you can then formulate a strategy to minimise their impact on your overall profitability.

Bonus round- The perfect customer

If the ‘cheap customer’ causes the most problems then we often find that the reverse can be true of customers who pay a fair price, or even overpay! These are the customers to aim for and to encourage.

Great customers may already be hidden in your data and it’s really wise to reward them so they stay loyal or even act as a cheerleader for your brand. Using RFM analysis can help to identify these ‘Champions’.

If you’d like to talk to an expert to help you identify issues that are harming your profitability or even just talk through your inventory management strategy, ecommerce or accounting as a whole, Outserve offer a free discovery call. We look forward to speaking with you!

For any physical product based business selling online (B2B or D2C), efficient stock management is vital to maintain a competitive edge in the...

Do you dream of a world where stock forecasts are simple, straightforward, and actually accurate?

Running an e-commerce business can be both rewarding and profitable. However, many businesses make mistakes that can cost them dearly. Here are 7...