Our Xero health check helps you work smarter

[av_one_full first min_height=” vertical_alignment=” space=” custom_margin=” margin=’0px’ padding=’0px’ border=” border_color=” radius=’0px’...

Complete accounting solutions focussed on profit and growth

Inventory management systems play a crucial role in thriving product businesses

Automating your core systems is the key to efficiency and effectiveness

Scalable software that grows with you

Product and inventory software that makes sense

Seamless integrations and automations

Whether they use a single solution or a full end-to-end integration of multiple software packages we are proud to be a part of our client's success.

Making Tax Digital (MTD) is fast approaching! With the New Year already underway, we thought now would be a good time to remind you of the basics of MTD and how Xero cloud accounting software can help make the transition as painless as possible.

HMRC have introduced MTD to improve the UK tax system. As a result of MTD, tax affairs will be changing and digital tax management will become mandatory. It is therefore important to get a good understanding of the changes you and your business may need to make.

Up until now, businesses have had to file with HMRC one huge document once a year. Now with MTD, small businesses will keep electronic records of their accounts using software such as Xero, and will digitally file their tax information on a quarterly business. Xero allows individuals to send information directly to HMRC and check their details online throughout the year to make sure their tax accounts are correct.

MTD for business (MTDfb) begins on 1 April 2019, starting with MTD for VAT. From April 1st, VAT-registered businesses who are above the threshold (£85k) will have to keep digital records and will also have to submit their VAT returns using compatible software.

The digital submission of income tax and corporation tax have been placed on hold until April 2020 at the earliest.

As Britain’s leading online accounting software with over 1 million subscribers globally, Xero has consulted with HMRC about MTD and is listed as a HMRC MTD compatible software for VAT.

As a cloud-based system, Xero makes data more secure. Xero also enables businesses to record tax more accurately and limits opportunities for errors along with fraudulent activity, giving greater peace of mind. Xero makes the process faster and more automated – something that is propelling businesses and accountants into the future by saving precious time.

At OutserveWeb, we know a thing or two about Making Tax Digital. Are you still trying to get your head around how MTD will affect you and your business? Do you need some MTD-friendly software for your accounts so that you can hit the ground running with MTD? We can help. Contact us on 01785 244080 or get in touch here.

[av_one_full first min_height=” vertical_alignment=” space=” custom_margin=” margin=’0px’ padding=’0px’ border=” border_color=” radius=’0px’...

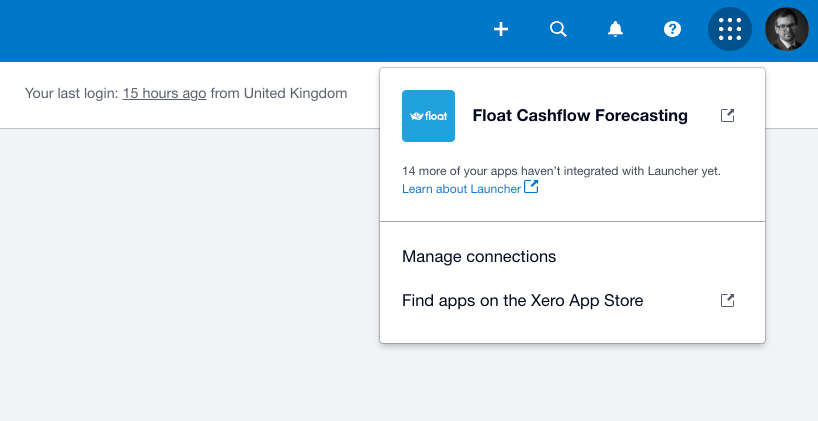

Xero has recently launched 🚀 (any excuse to use the rocket) the Xero Launcher